A look under the hood of the venture capital sector in SA

While the latest South African Venture Capital Association (SAVCA) report on Venture Capital(VC), indicates that the South African VC industry is experiencing significant growth with an encouraging rise in the number of new fund Administrative Managers, exits and deal flow, South Africa has failed dismally in funding concept-stage technology start-ups and greenfield exploration projects that Aziza Coin’s Foundation plans to assist with.

The SAVCA 2015 VC Survey suggests that South African VC industry now represents over R2bn in assets under management, with healthy confidence levels that are commensurate with reported rising deal activity, a pleasing exits record and a significant increase in VC fund Administrative Managers and industry professionals.

These findings are encapsulated in the SAVCA 2015 VC Survey, which covers VC-type transactions that took place between January 2011 and July 2015, and follow two previous VC studies produced by the Southern African Venture Capital and Private Equity Association (SAVCA), in 2010 and 2012.

The latest survey reveals that in the 2011-2015 period, 21 public and private VC fund Administrative Managers and angel investors completed 168 new deals amounting to a total value of R865 million. As at July 2015, total VC assets under management were valued at R1.87 billion, comprising 187 deals.

These optimistic views mask damning evidence as to the extent the market has failed start-ups in South Africa. In a world of downsizing, automation and business process outsourcing, a job for life is no longer a realistic prospect for any employee. Large businesses, governments and the NGO sector around the world are losing jobs, causing grinding poverty, extremism and social unrest. Entrepreneurs are alone in standing up to this tsunami of employment destruction: In Uganda, one of the world’s poorest economies, 65% of all jobs were created by start-ups. In Norway, which has a $1 trillion sovereign wealth fund to share between its 5 million citizens, 57% of all new jobs were created by Start-ups. South Africa stands in between these two extremes with 62% of jobs created by its start-ups. When one includes small and medium sized businesses, over 100% of net jobs created

in the USA, 85% of net jobs created in the UK and an estimated 90% of net new jobs in South Africa were created by SMEs.

South Africa desperately needs jobs to alleviate its poverty, and it is universally accepted that the private not the public sector needs to create them. In the latest Quarterly Labour Force Survey issued by Statistics South Africa, there are 37 million adults in the country and 12 million or 36% of the potential workforce are unemployed – one of the highest unemployment rates in the developing world.

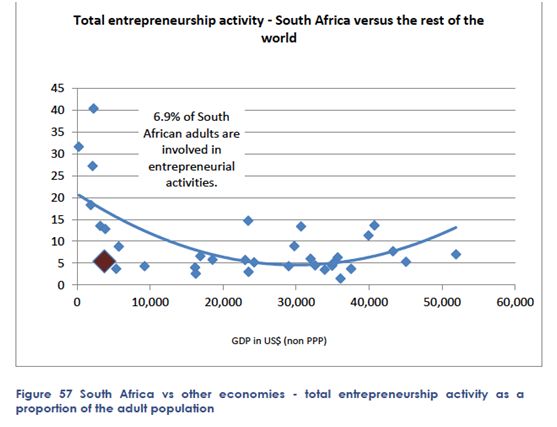

While South Africa has a lower proportion of entrepreneurs than other economies at its stage of development – only 6.9% or 2.5 million of South African adults run their own business according to the Global Entrepreneurship Monitor17. The number should be closer to 15% if the global trend is to be followed. And it is exacerbated by the fact that few of these create jobs, the vast majority is made up of necessity entrepreneurs who subsist in the informal sector. The kind of entrepreneurs who create the jobs quoted above are High Expectation Entrepreneurs, which the Global Entrepreneurship Monitor defines as a person who intends to employ more than 20 people in five years’ time. In fact, these comprise fewer than 2% of the South African entrepreneur population and yet they created 27% of all net jobs in the South African economy last year. Studies in Tanzania (a low income economy) and the United Kingdom (a high-income economy) suggested similar proportions.

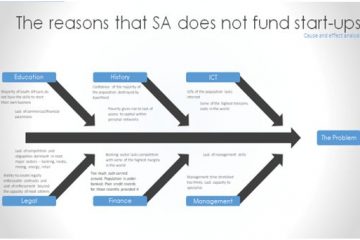

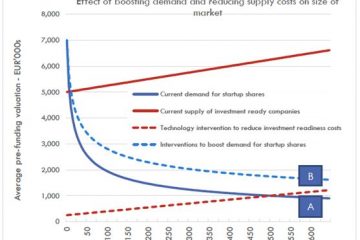

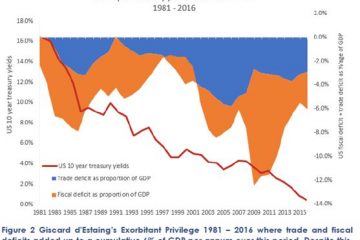

The founder of Alumni Energy Investments, Shakes Motsilili has lobbied discretely and effectively for support of angel funding into start-ups. Citing experience in the UK, where Enterprise Investment Scheme tax breaks have enabled over R250 billion rand be invested into over 28,000 start-ups, it is estimated that over 50% of the UK’s high expectation entrepreneurs received funding via EIS. South Africa has an estimated 50,000 high expectation entrepreneurs who in turn created 25% of net new jobs in South Africa between them. Yet according to the SAVCA 2016 report, only 44 were funded, and every one funded was not a start-up. The sad reality is that only 44 of these companies or 0.1% of the High Expectation Entrepreneur population received funding 2016. This abject case of market failure is the most important reason for optimism towards the Aziza Coin Initiative. Currently, it faces literally no competition, leading to a case of mis-pricing of risk capital in the favour of the investor: This means that any funding into the space will achieve better valuations than in a more established venture capital market would when funding innovation projects. It also means that its investee companies will face less competition due to a dearth of potential new entrants. Furthermore, the Aziza Coin assisted start-ups, especially in the BEE space, which the Foundation plans to embrace, will be able to compete with larger, lethargic incumbents unused to nimble technology-rich competitors, particularly in FinTech, Telecoms and the Resources Sectors. The government has and will continue to be supportive of the Foundation’s efforts to fund innovation by giving concessionary terms with licenses.

0 Comments